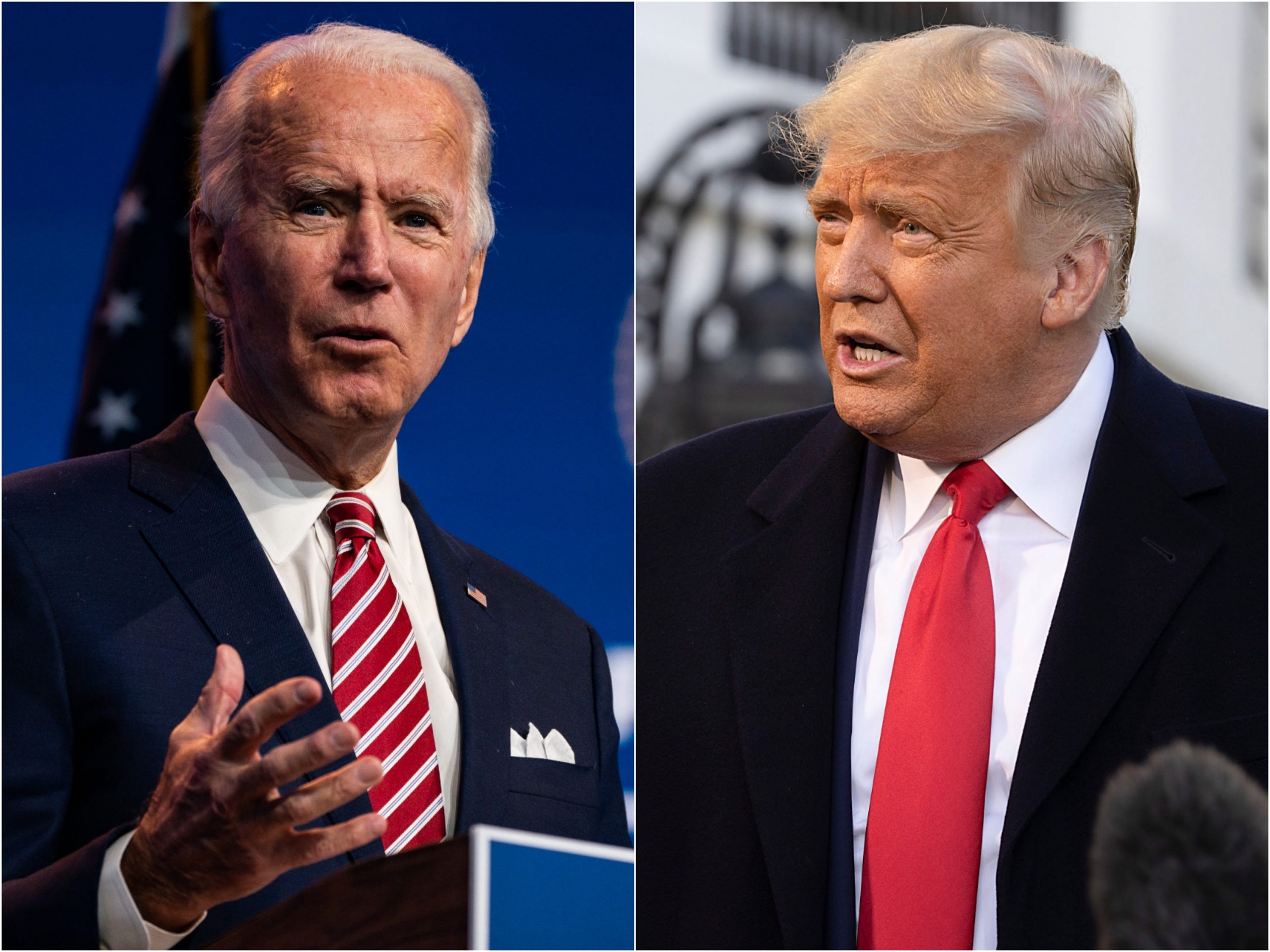

Salwan Georges/The Washington Post via Getty Images, Tasos Katopodis/Getty Images

- A bipartisan group of lawmakers is seeking to reverse Trump's 2017 SALT tax cap.

- The demands of the "SALT Caucus" could impact Biden's $2 trillion infrastructure package.

- The caucus said the cap resulted in higher tax bills in New York, California, and other states.

- See more stories on Insider's business page.

A congressional battle line was forming last week over former President Donald Trump's SALT tax cap, which is threatening to derail President Joe Biden's $2 trillion infrastructure proposal.

A bipartisan group of more than two dozen lawmakers, calling itself the SALT Caucus, formed to push for Trump's cap on tax deductions be reversed. They sought to include it as part of Biden's plan to stimulate the nation's economy.

"This issue is so critical to our state and our constituents that we will reserve the right to oppose any tax legislation that does not include a full repeal of the SALT limitation," the newly formed group said in a letter.

The caucus could cause problems for Biden as he prepares to push a massive spending bill through a deeply divided Congress. Democrats hold a slim majority in the House, adding greater weight to each vote against his plan.

For Biden to eliminate the cap as part of his spending plan, there would have to be "a discussion about how that would be paid for, what would be taken out instead," Jen Psaki, White House press secretary, said Thursday.

She added: "As you also know - just with our little calculators out - it is not a revenue raiser, and so it would add costs - and potentially significantly - to a package."

Progressive Rep. Alexandria Ocasio-Cortez seemed to be at odds with the caucus last week.

"I don't think we should be holding the infrastructure package hostage for a 100% repeal of SALT," Ocasio-Cortez, of New York, told a pool reporter.

SALT, which is part of Trump's 2017 tax cut, placed a $10,000 cap on federal deductions for state and local tax. The caucus said the cap resulted in increased tax bills in New York, California, and other high-tax states.

Eliminating the cap would likely lower taxes for the wealthy, who could claim higher deductions on their federal returns. But it could also raise the cost of Biden's plan, making it more difficult for House Speaker Nancy Pelosi to usher the plan through the House.

New Jersey's Rep. Josh Gottheimer, a member of the new caucus, also spoke out. He said it "it is high time that Congress reinstates the State and Local Tax deduction, so we can get more dollars back into the pockets of so many struggling families - especially as we recover from the pandemic."